Growth vs. Value During COVID-19

Posted on May 26, 2020

The fallout of the COVID-19 global pandemic on stock markets this year has been dramatic. The U.S. equity market (S&P 500) fell by more than 33% over the course of 23 trading days beginning in late February before ultimately rebounding to much higher levels. It has been interesting to observe how different segments of the broader stock market have performed in light of recent volatility – one of those being the substantial outperformance of growth stocks relative to value stocks, the continuation of a multi-year trend.

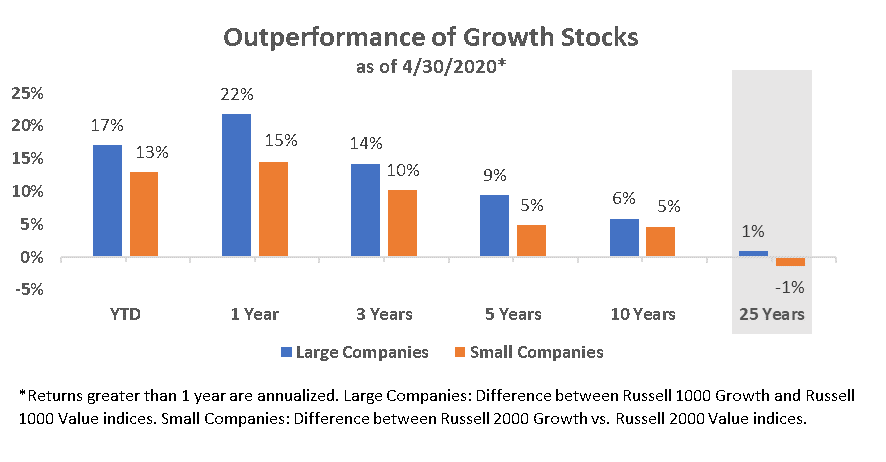

Historically, it is very common to see growth and value stocks either outperform or underperform each other over different periods of time, as well as see these differences persist for many years. However, it’s also true that the performance of growth and value stocks tend to converge over long periods of time. As the chart below reveals, the recent outperformance of growth stocks has been quite strong over the past several years, only becoming more pronounced this year during COVID-19. But when we look back over 25 years (and longer), the difference between growth and value becomes much less pronounced.

Frankly, it makes sense that growth and value stocks tend to converge on each other – performing similarly over very long periods of time. The total return potential of growth and value tends to be fairly similar in the aggregate – it’s just a matter of how those returns are generated. Growth companies tend to grow faster and reinvest their cash flows back into their businesses to generate higher future returns for their shareholders, while value companies tend to grow slower and payback more of their cash flows directly to their shareholders via share buybacks and dividends.

If you happen to own a large proportion of value-oriented companies that pay good dividends, you may be displeased with your recent performance results – perhaps wishing you owned nothing but technology stocks! However, if history is any guide (and it typically is), at some point we expect value stocks will lead the market and the differences between growth and value will once again collapse on each other.

While accounts at The Sanibel Captiva Trust Company and its divisions of The Naples Trust Company and Tampa Bay Trust Company are individually managed and tailored to our client’s unique goals and constraints, we also believe it is important to own companies across different segments of the market (growth and value), including reasonable diversification across the various sectors and industries of the economy. This gives you the balance necessary to maintain a productive portfolio. We’re here to help and welcome your questions.

Ian N. Breusch

Chief Investment Officer

LEGAL, INVESTMENT AND TAX NOTICE: This information is not intended to be and should not be treated as legal advice, investment advice or tax advice. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal or tax advice from their own counsel. Not FDIC Insured | No Guarantee | May Lose Value

IRS CIRCULAR 230 NOTICE: To the extent that this message or any attachment concerns tax matters, it is not intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law.