Bridging the Financial Generation Gap

Posted on February 11, 2021

Most families have a member like the “fun aunt” who for years has hosted the extended family holiday get-togethers renowned for their conversations and board games. Over the last generation, the great nieces and nephews have begun arriving with their smart phones and use them in exclusion to face to face socializing – the whole point of the gathering. The great aunt is not pleased and about to speak to the parents when she notices they have also taken out their smart phones. She then establishes a new holiday policy: Going forward all cell phones will be checked in the front door basket upon arrival. The result is an enjoyable day filled with anticipated conversations and board games. Sound familiar?

We now have six generations living side by side in this country, from births in the early 20th century to now. Think about what has transpired in that time – from horses to spaceships, from oral communication to FaceTime. A family member who learned phonics in a one-room schoolhouse can be in the same room with another member who takes virtual classes to create “apps.” A baby boomer who has balanced a checkbook his entire life has grandchildren who do not know what a checkbook is – but view their bank balances daily with the tap of a finger. The technological and communications divide between them is as wide as any time in history.

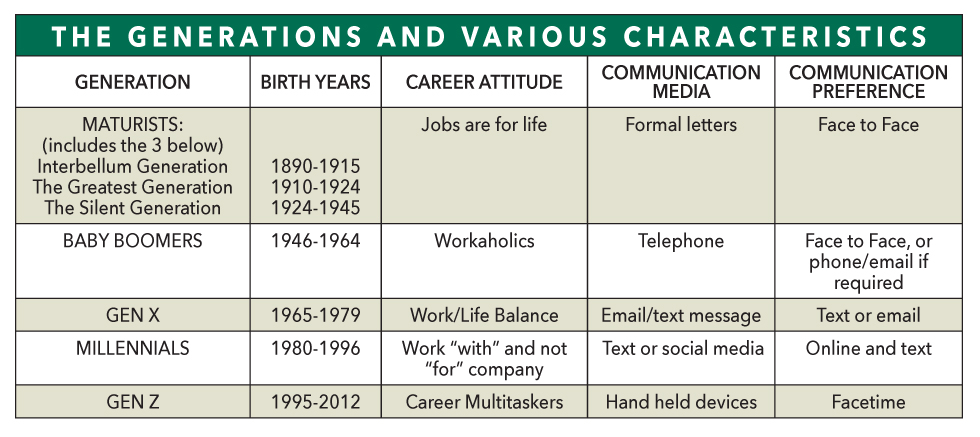

Each generation holds different values and attributes concerning communications and careers (see the table). It is no surprise that an early Baby Boomer struggles to relate to Millennials and Gen Z’s.

Many of our clients fall into the “Silent” and “Baby Boomer” generations, and their children and grandchildren are seemingly worlds apart as Gen Xers and Millennials. We are fortunate to often work with clients’ multiple generations and spend thoughtful time discussing sensitive inheritance and estate planning issues. The older generation is concerned not only about the estate plan itself, but how to effectively communicate this information with the children and grandchildren. The older generation is concerned not only about the estate plan itself, but about family dynamics – particularly when children are being treated fairly but differently.

How to communicate these concerns within the family tree is always an important part of a planning discussion. But that communication can be bottom up as well as top down – especially when it comes to hearing the Gen Xer’s and Millenials explaining Iphone and Smart TV features to their Baby Boomer elders. Discussing generational differences with our clients allows for a more robust planning conversation which ultimately assists in communicating the wealth management plan with the family.

In this world of increasingly fast-paced change, we at The Trust Company are here to assist you and your families to help ensure appropriate planning and effective communication of your desires and goals.

Cherry W. Smith

Wealth Services Advisor

The Sanibel Captiva Trust Company is an independent trust company with $2.8 billion in assets under management that provides family office and wealth management services, including investment management, trust administration and financial counsel to high net worth individuals, families, businesses, foundations and endowments. Founded in 2001 as a state-chartered independent trust company, the firm is focused on wealth management services that are absolute-return oriented and performance driven. Each portfolio is separately managed and customized specifically to the client’s yield and cash-flow requirements. The Naples Trust Company and The Tampa Bay Trust Company are divisions of The Sanibel Captiva Trust Company. Offices in Sanibel-Captiva, Naples, Marco Island, Tampa, Belleair Bluffs-Clearwater and Tarpon Springs. www.sancaptrustco.com