A Strategy for Income-Generating Securities

Posted on July 26, 2022

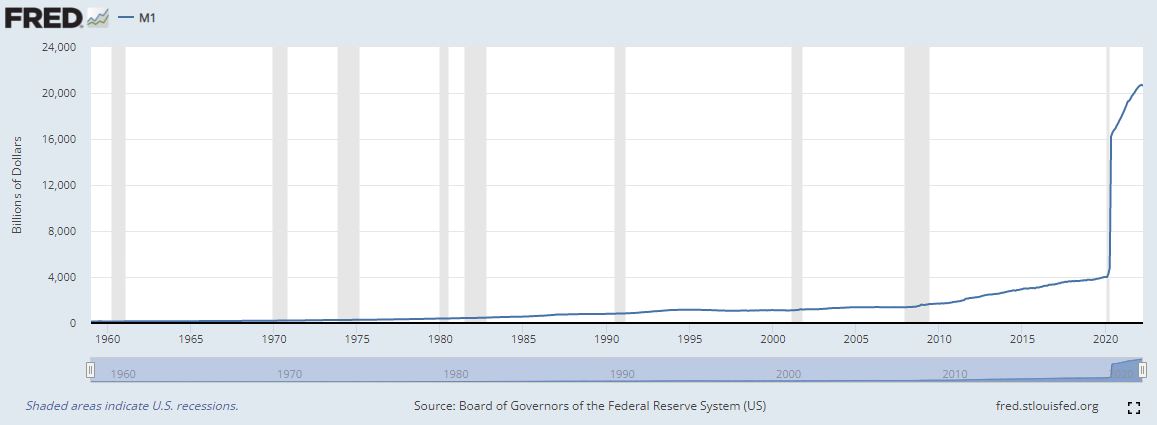

Ever since the Federal Reserve and governments around the globe simultaneously went to full-blown accommodation mode, all market corrections have been swiftly followed by a sharp “V-shaped” recovery sending stocks to new all-time highs. “Buy any and all dips” became the mantra of retail and institutional investors alike, and equities – like clockwork – responded. Fast forward to 2022: Accommodation has turned restrictive; the Fed is unwinding its balance sheet and is beginning to hike interest rates in the face of a looming recession to combat the very inflation that surprised them. Inflation is a direct result of money supply growth, and American history has never witnessed money supply growth as depicted in the chart above.

A V-shaped recovery is no longer a sure thing in a restrictive, slower growth environment. Where can investors turn for returns in the meantime? The answer: Get paid while you wait. Consider high-quality dividend-paying equities that will pay a consistent income stream as this bottoming process plays out. The U.S. economy will recover, and income-generating securities can help bridge the gap until it does. This strategy has several benefits that ultimately lead to something this father of young children is unfamiliar with… sleeping well at night.

High-quality dividend-paying equities are historically less volatile and provide more downside protection than their growth counterparts. For example, the Russell 1000 Value Index of dividend payers has fallen about 10% year-to date vs. the Russell 1000 Growth Index, which has fallen about 24% as of July 25, 2022. Dividends appear to be insignificant on the surface but compounded over time they play a meaningful role in wealth accumulation. Dividends have contributed 32% of the total return for the S&P 500 going back to 1926. During the 10-year period ending June 2021, the S&P 500 price return was +113%, but +191% when you reinvested dividends — nearly double the return in just a decade! There are pitfalls to avoid, however, when chasing income-generating securities:

1. There is no free lunch with high yields. Avoid that temptation to chase yields of 7% or more. It is very difficult for a company to grow if it pays out all its profits to shareholders. A high yield further signals that investors fear a dividend cut in the future. Yields between 2% and 4% have been a sweet spot.

2. Don’t overplay the style box. While we’re highlighting income here, long-term investors should own growth as well. The pendulum swings back and forth between growth and value, and it’s good to have something working in the portfolio all the time. Don’t chase past performance of growth or dividend stocks either. Remain diversified and simply own both.

3. Don’t give up on dividend stocks to chase excitement. Slow and steady can still win the race in investing. Contact Us with any questions.

Equity valuations have recently reset to dramatically lower, and more-attractive, multiples, but not all companies have deserved the reset: Select companies continue to produce consistent growth in cash flows and earnings and continue to increase their dividends. It is more important than ever to be selective and to emphasize quality companies that trade at reasonable fundamental valuations relative to their growth. This methodology aligns perfectly with our philosophy here at the Trust Company.

Lastly, on the topic of income, don’t ignore the now-unpopular bond market. High-quality short-term bonds look more attractive today than they have in several years. Premiums have come down substantially thanks to the recent spike in interest rates, and that in turn has boosted the yield to maturity. For the first time in more than a decade, select fixed-income securities are showing positive attributes as a part of a broadly diversified portfolio. Equities will continue to be the primary driver of long-term growth, but bonds are no longer as undesirable as advertised.

Do you have questions? We are happy to help. Click here to Contact Us.

LEGAL, INVESTMENT AND TAX NOTICE: This information is not intended to be and should not be treated as legal advice, investment advice or tax advice. Readers, including professionals, should under no circumstances rely upon this information as a substitute for their own research or for obtaining specific legal or tax advice from their own counsel. Not FDIC Insured | No Guarantee | May Lose Value